206. How to Save, Invest, and Retire Early

The Practical Guide to Achieving Financial Independence

This year, I reaped the fruits of my financial labors by taking a sabbatical. I was afraid of using my savings without an income, but the reality was quite different. One year later, my net worth is up $111,000 despite spending more than usual and not working.

I am so grateful to my past self for learning about personal finances and diligently implementing these practices because these changes have completely transformed my life. I used to spend almost every waking hour working as a PA to make six figures, and now it happens without me even noticing.

This makes me want to climb the tallest mountain and scream, “Increase your savings, invest in index funds, and know your FI number” for all to hear. Fortunately, Michelle and I have a podcast, so here it is!

Save Money

Start an Emergency Fund

I like to keep at least one year’s worth of spending in my savings account in case of an emergency. Three- and six-month emergency funds are also very reasonable. When I first started saving up for my emergency fund, I put in $250 every paycheck. It seemed like such a small amount relative to the amount I wanted to have in my account, but the years pass so much more quickly than I realized. Those short hours I took to set up direct deposits into my savings account made a lifetime of difference.

Track Your Expenses

This is the least sexy thing in the world—at least that’s what others tell me. I LOVE tracking my expenses. I would say this is probably the most important step in building wealth. When I first started tracking, I challenged myself to see how frugal I could be, and I had >80% savings rates during those years. Later, I found that I could live very comfortably with everything I desired with a 50% savings rate.

Savings Rate

I love this Mr. Money Mustache chart from The Shockingly Simple Math Behind Early Retirement, which compares savings rate and working years until retirement. Not only do we increase how much we save and invest when we watch how much we are spending, but we also decrease the amount we require. Less money spent = more freedom.

Invest Money

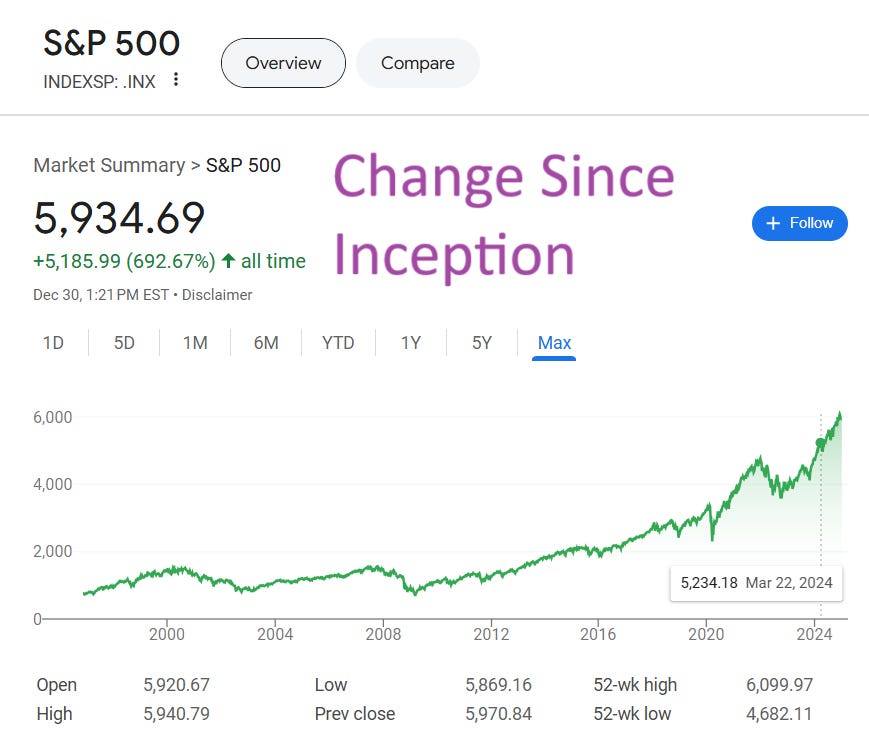

Michelle and I both invest in broad-based index funds that resemble the S&P 500. These funds have low expense ratios (fees) and regularly outperform actively managed funds, where “experts” choose the stocks that go into the fund. With broad-based index funds, the fund inherently includes the top 500–1000 companies in the U.S., and this is regularly re-evaluated to match the top companies in the country.

In the short term, index funds can decrease for months or even years at a time, but when looking at a long time frame, index funds are continuously increasing. Of course, there could be a black swan event where the U.S. economy collapses forever—hence homesteaders and bunker builders.

Know Your FI Number

The financial independence number, or FI number, is the amount of savings or investments you need to cover your living expenses indefinitely without needing to work. It is your retirement number. It's often calculated as:

FI Number = Annual Living Expenses × 25

For example:

If your annual expenses are $40,000: $40,000 × 25 = $1,000,000

If your expenses are lower, like $25,000: $25,000 × 25 = $625,000

This formula is based on the 4% rule, which assumes you can safely withdraw 4% of your savings annually while your investments continue to grow. Knowing this number is helpful in understanding how close you are to being retired. It is also inspiration for decreasing your savings rate.

What About You?

What strategies do you find helpful in reaching financial independence? Have you implemented any of the above strategies? Comment below.

** THIS IS NOT FINANCIAL ADVICE ** This is just for your entertainment. We don’t judge how you get your jolly.

Show Notes:

Community Shout Outs:

Thanks, India for your compliments on our sabbatical episode!

Thank you Arul for listening we are excited to hear about your manifestation app and future podcast!

Ready to transform your writing? Click here

How Can I Help:

Gentle but firm accountability to help you write consistently - support in knowing when to push and when to pause

Critical and supportive essay feedback for up to 5 pieces a month (1000-2000 words)

Build your online audience authentically without compromising your creativity

Why Work With Me?

My creative journey began when I left software sales in 2020 and started a podcast, Build A Wealthy Spirit, with my sister. I started writing through Write of Passage in October 2022 - starting from zero subscribers and a brand new Twitter account with 3 followers.

Since then, I've published 40+ essays and guided hundreds of writers as a Write of Passage mentor, editor, and watch party host across four cohorts over two years. My experience includes leading their Twitter growth mentorship between two cohorts.

Having built my own audience from scratch (initially under a pseudonym!), I deeply understand the challenges of developing a writing habit and growing a following. I'm also committed to protecting my creativity and making sure that growing an audience is fun for me.

In just over two years of writing online, I've:

Built an engaged audience of 2,200+ on X (including a tweet with over 1M impressions) as well as 1,200+ newsletter subscribers on Substack (including an essay with over 100 likes and 90 comments)

Created new income streams through writing, including freelance work and course creation

Co-founded "Turn Your Layoff Into A Sabbatical," a cohort-based course

Been featured on podcasts, spoken at events and connected with notable creators in my space that I met through my writing, podcast and Twitter

I know the power of writing online and creating a lighthouse of luck that attracts opportunities that can feel impossible when you are getting started.

The Writing Coaching Program

1:1 Coaching

Weekly 1 hour sessions to develop your writing strategy, refine your voice, discuss distribution ideas and overcome creative blocks.

Writing Feedback

Detailed feedback on 1-5 drafts per month (up to 2500 words each) to strengthen your writing.

Growth Strategy

Actionable tactics to grow your audience across newsletters and social media.

Community Support

I'll create a WhatsApp group with everyone who joins so that there is an opportunity to connect with a tight knit group of writers supporting each other's journey.

Monthly Group Calls

Learn from peers, share wins, and get answers to your writing questions.